Tips for keeping good SMSF records with Selfmade

Record keeping is an important part of running a SMSF.

Record keeping for a SMSF covers a range of activities from the fund’s legal documents and any updates made to these documents over time, to annual tax and compliance statements all the way down to recording and verifying all the transactions made by the SMSF during a given year.

Part of maintaining quality records is setting up a regular process and maintaining records in a way that makes it easier for you, and the Selfmade team to help lodge your fund's annual return and complete the fund's independent audit each year.

At Selfmade we provide a set of tools that help our clients stay on top of their record keeping and make the SMSF journey less stressful. Here is some more information about how Selfmade can help.

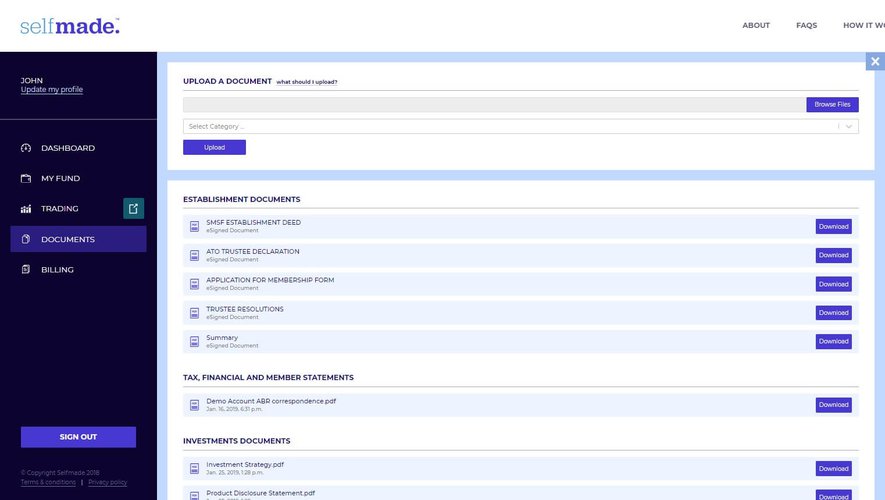

Document Management

Selfmade’s online portal contains a document management section. This area is available to clients to manage all of their SMSF documents in one place. Any documents that we create for your fund will be available here. We use categories to separate your fund's more permanent records from the records that relate to fund investments or regulator correspondence.

For example, under Establishment documents you would see:

- the fund's trust deed, and;

- details for the corporate trustee (if applicable)

- minutes of trustee meetings

- all signed trustee declarations

- records of trustees consenting to their appointment as a fund trustee

- records of all changes in fund members and trustees.

or under Investment documents you would save;

- investment portfolio reports

- share trade confirmations

- reasons for decisions on the storage of collectables

- rental statements or lease agreements for an investment property

Keeping these documents together in the Selfmade portal provides several benefits. Firstly, it simplifies the process of compiling the records you need to complete the funds tax return and records required to complete the SMSF’s independent audit. Secondly, by saving these records in the system the Selfmade team will be able to update any aspect of the funds accounts based on the information you have uploaded.

TIP: When ever you pay a bill or spend any money in relation to your SMSF take a photo on you phone, right there and then, and upload the image to the Selfmade Portal. Our portal can handle most picture types. This will save you a lot of time at the end of the year looking for receipts and records that can be easily misplaced.

Legal requirements for record keeping

The rules for SMSFs make it a legal requirement for funds trustees to maintain a quality set of records for the SMSFs activities.

Other reasons for keeping good records of your fund's activities include:

- making it easier for you and Selfmade to complete your fund's annual return

- monitoring the financial situation of your fund to assist you making sound investment decisions

- making the best use of your

So what records do you need to keep?

You need to ensure you keep the documents that you have used to prepare your fund's annual return. You need to keep documents that:

- explain how your fund's income has been generated, this includes things like;

- dividend statements from shareholdings

- distribution statements from managed funds and unit trusts

- rental statements for investment properties

- any other income statements from your fund’s holdings

- explain your fund's deductible expenses, this could include:

- fee statements from your property manager for an investment property

- spending on maintenance and repairs

- fee statements from your financial adviser or investment platform provider