Managing your own super fund can give you access to a broader range of investments on top of the usual shares, term deposits, managed funds and property. With Selfmade, you can take advantage of extra investment options such as exchange traded funds, mFunds and warrants.

The facts

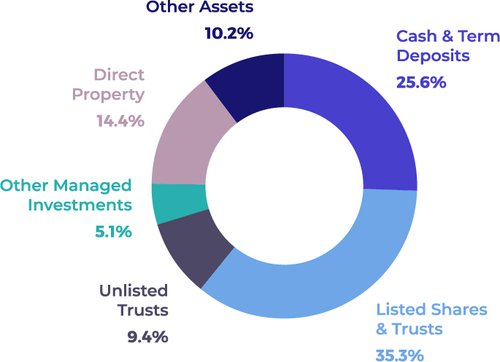

The majority of investments made by SMSFs are in:

- Cash

- Term deposits

- Listed securities

- Trusts

- Managed funds.

See the breakdown of SMSF investment types below.

How Selfmade does it

Selfmade uses Macquarie Bank’s leading Cash Management and Online Trading products to help you invest your super. This sophisticated trading platform allows you to invest in options such as: - Australian shares

- Exchange traded funds (ETFs)

- mFunds

- Warrants

- Cash and term deposits.

- Access market insights and company research from Morningstar

- Access news from Dow Jones

- Set up SMS and email alerts, end of day watch lists and portfolio email reports

- Choose a range of market data packages to help you manage your super investments.